info@farmenergyni.co.uk

Office Hours: 9:00 - 17:00

028 7930 0606

Call Now

Office Hours: 9:00 - 17:00

Call Now

While it’s still too early to have a crystal clear understanding of the full extent and economic impact triggered by the coronavirus pandemic, many sectors are likely to be significantly different going forward. For the energy industry, that is expected to result in price volatility as we progress through 2020 and beyond.

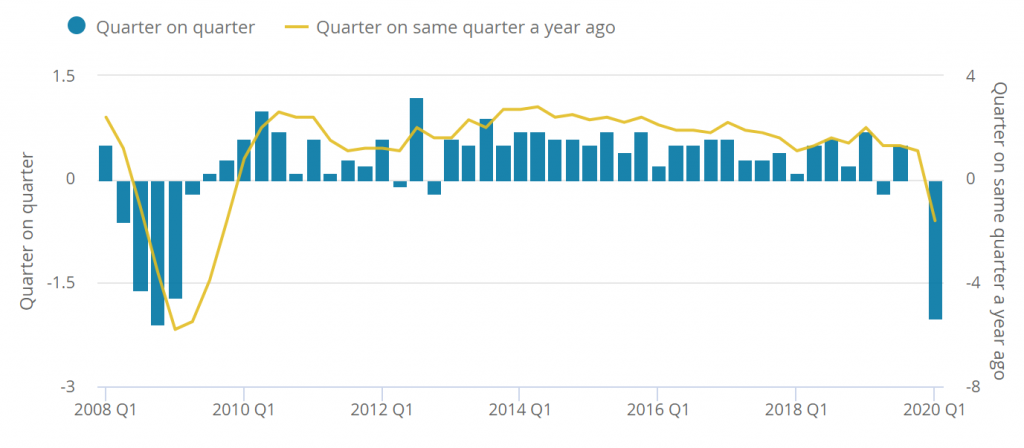

We heard Rishi Sunak, the Chancellor, say it was clear the pandemic would have a very significant impact on the UK economy. More recently, the first official estimate of economic activity (GDP) confirmed that, despite lockdown officially only starting on 23 March, in the first three months of this year the UK experienced the sharpest economic contraction since the peak of the financial crisis in 2008, falling 2.0%.

Source: Office for National Statistics (link)

The widespread challenges to economic activity are set to continue and any hope of a rapid bounce back could be wishful thinking. The Office for Budget Responsibility has estimated that GDP could fall by more than a third in the second quarter of the year and by 13% for 2020 as a whole. With business activity effectively brought to a standstill globally, the International Monetary Fund has also warned of an economic slump unparalleled and eclipsing the Great Depression of the 1930’s.

Baringa Partners, a management consultancy, produced a report in April 2020 which explores the current situation, possible outcomes for power markets and the impact of policy change. Here we outline the key aspects of their report.

Electricity

Gas

Oil

Carbon – EUA

The impact of the evolving situation represents a large and unexpected supply and demand shock for the energy industry and pricing, in particular electricity prices and Renewable Generators, combined with lower consumption, a significant reduction in travel and an oil price war that has caused price volatility for electricity, gas and carbon.

Tune in next week for Part 2. Farm Energy NI are well informed of the developing situation, guided by advice from the appropriate authorities and can answer any of your questions or concerns. You can contact them at: www.farmenergyni.co.uk or 028 7930 0606